Whether you are the target entity or the buyer, Fauri Law is here to provide full-service representation in mergers and acquisitions.

Our experienced team can assist you in structuring the transaction, conducting due diligence, drafting agreements, acquiring intellectual property rights, and navigating complex legal issues. Trust us to protect your interests throughout the M&A process.

Download your Mergers & Acquisition Guideline

Full-Service Representation

Mergers and acquisitions are time-sensitive transactions that can involve several sensitive issues. At Fauri Law, we provide hands-on legal service at every step of the transaction:

- Structuring the transaction

- Conducting legal due diligence

- Drafting non-disclosure, non-compete, and non-solicitation agreements

- Drafting term sheets and letter of intent share acquisition

- Drafting and negotiating asset and share purchase agreements

- Drafting escrow agreements

- Acquiring intellectual property rights

Responsive and detail-oriented, we make sure that your interests are fully protected. We identify potential problems, help you manage your risk, and guide you through the transaction to ensure you are comfortable and able to make informed decisions at every turn.

For more information, download your free copy of our Mergers & Acquisition Guideline.

Thorough Due Diligence at the Speed of Business

Thorough due diligence is vital to the success of any transaction. Unfortunately, due diligence is often seen as a stumbling block that slows down the process. At Fauri Law, we understand that time is money and the value of your transaction hangs in the balance. We perform our due diligence review as quickly as possible without sacrificing quality. We perform a 360-degree review of the transaction, but keep the deal moving forward. You can count on it.

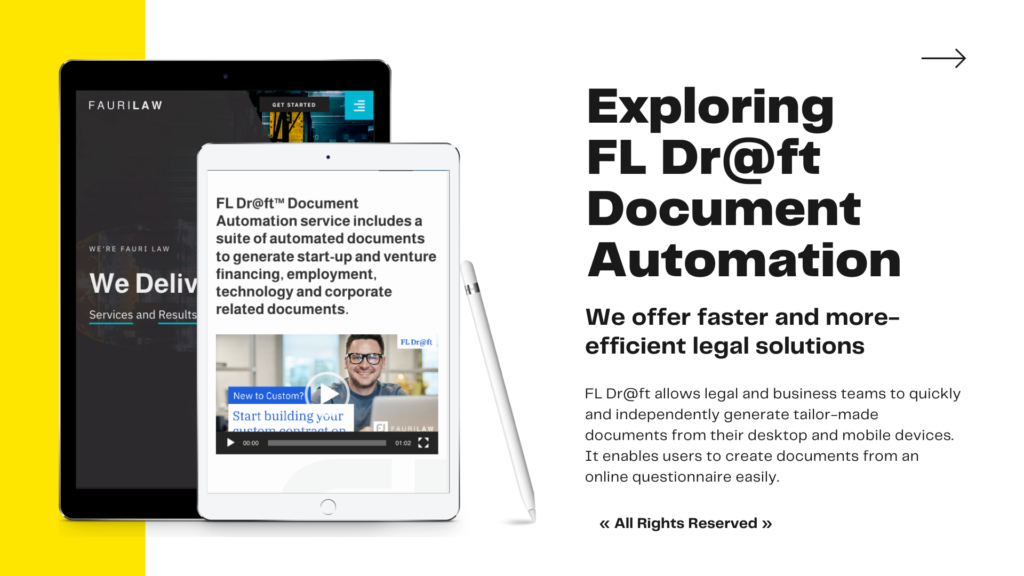

Start Building Your Documents Now

Let’s build your Letter of Intent share acquisition or commercial, promissory note, consulting, employment or stock option agreement, software license agreement, SAFE document and more so that you can get organized, raise money and gain credibility to expand your business.

Visit our FL Dr@ft™ Automated Documents section of the FLConnect or FLStartup Accelerate Plans to get started today.

Get Started

If you’re looking for help with a merger or acquisition, let’s have a conversation about what we have to offer. To learn more about the basic forms of merger and acquisitions agreement, download your free copy of our Mergers & Acquisition Guideline.

- A Software Publisher company in Toronto in a CA$10 million capital restructuring, including a CA$4.5 million convertible note and SAFE notes, ensuring a compliant, investor-friendly framework to support the Company’s growth and future equity conversion.

- A Canadian AI startup in securing CA$5 million in funding round, achieving a CA$20 million post-money valuation! This milestone paves the way for the startup’s expansion into new geographical locations and involvement in multi-billion dollar real estate projects.

- Aviation Company: Led the successful acquisition of strategic intellectual property for revolutionary single-engine helicopters and UAV systems, backed by a UAE venture capital.

- Meridian Credit Union, a leading financial institution in Toronto, in a share subscription transaction in FinTech Startup that includes legal due diligence, software licensing, drafting of transactional documents and securities law compliance on matters such as private issuer and exemptions from prospectus.

- Motusbank, a federally chartered online bank in Toronto, in standardizing the terms and conditions of the bank’s cloud-based services, including Saas agreements, software licensing agreements, click-wrap agreements, and other technology-related agreements for the use of the bank’s online users.

- Fincantieri, the largest naval shipbuilding group in the world, in naval ship IP design agreements, transfer of technology and licensing agreements negotiated and signed with several armed forces in the Middle East region to protect Fincantiari’s intellectual property rights.

- Infrastructure Ontario‘s Request for Proposal Documents (RFPs) of the Go-Rail Expansion Project.

- Infrastructure Ontario‘s Go-Rail Expansion project agreement, a single fully integrated contract using the Design-Build-Finance-Operate-Maintain (DBFOM) model.

- Infrastructure Ontario’s Transit Oriented Communities (TOC) project agreements including term sheets, joint ventures, construction lease and option agreements with developers to jointly build mixed-use developments as part of Ontario Line subway project.

- Infrastructure Ontario‘s Real estate matters such as expropriations/ collect and compete, land acquisition and disposition.

- Jordan Aviation‘s major shareholder in an airline company, to conclude a US$26 million share acquisition transaction from a large international private equity firm and related escrow agreements with Citi Bank London.

- Jordan Aviation’s major shareholder in an airline company, to conclude a US$10 million share acquisition transaction.

- Jordan Aviation, in its set-up of an aviation fund of US$30 million. Established fund company, management and sponsor companies. Prepared investment management agreement and subscription agreement. Moreover, drafted dry lease contracts for aircrafts as part of the fund transaction.

- Fincantieri, in the negotiation of a joint venture transaction with Al Zamil Shipyard in KSA for the design and construction of several offshore vessels and building of facilities for military and offshore vessels in the new King Abdul Aziz Port in KSA.

- National Holding, in the acquisition by a German firm (Knauf) to 51% stake in National Holding’s subsidiary.

- National Holding, in a joint venture transaction with Vivartia, a Greek holding group based in Athens.

- National Holding, in a US$36 million acquisition by Qatari sovereign wealth fund to National Holding’s shares in a Steel Factory in Egypt.

- National Holding, in a US$40 million capitalization in a home appliances factory in Jordan, with ownership restructuring.

- Dubai Bank and Dubai Holding, a global conglomerate and sovereign wealth fund of the government of Dubai and its ruling family, in producing a due diligence report and structuring advise in respect of a US$300 million cross-border acquisition/ privatization in a state-owned Jordanian Bank.

- Dubai Holding in producing four separate legal due diligence reports with respect to acquisition transactions totaling close to US$200 million in Eastern investment group holding UK, International Energy Management Company, Jordan Airline Training and Simulation (JATS) and Jordanian Flight and Catering Services Company (Subsidiary of Alpha Co. -UK);

- Kuwait National Bank in producing a due diligence report with respect to acquisition transaction in Bank Al Etihad in Jordan.

- National Holding, in several international procurement and sale of goods contracts and trade between countries that involved contract drafting and other banking documentations such as letter of credits, bank guarantees and other documents for shipping and handling of goods based on Incoterms Rules.

- Fincantieri as part of the in-house legal team, in closing a US$5.6 billion naval shipbuilding contract signed with the Qatari Navy in 2016.

- Fincantieri as part of the in-house legal team, in the negotiation of US$ multi-billion procurement contracts, to equip and arm newly ordered warships, with suppliers such as Airbus, Raytheon, MBDA, Rolls-Royce, Thales and Leonardo.

- Eagle Hills, a leading real estate developer, in several hotels operation agreements with Marriott Inc to license the operation of several (5) stars hotels and resorts in the Middle East region including St. Regis Hotel and residences, W Hotel & Residences and Westin Hotel.

- Engie, a French multinational power company, to structure the set- up and finance of a 150 MW solar power project in Jordan.

- Fincantieri, in closing a complex “Engineering, Procurement and Construction” contract for a military shipyard in the UAE and related joint venture contract for the management and operation.

- Fincantieri in a US$250 million refitting contracts of naval units (ISS, FOS, ILS) with several naval forces in the Middle East.

- National Holding, in several international procurement and sale of goods contracts and trade between countries that involved banking arrangements such as letter of credits, bank guarantees and other documents for shipping and handling goods.

- National Holding in the setup, design and construction of Greenfield cable factory in Algeria.

- Damac Properties in providing contract drafting to construction, consultancy, plot and unit SPA related to US$ multi-billion real estate projects in Dubai, Abu Dhabi, Jordan, Egypt, Lebanon, KSA and the UK based on FIDIC, NEC and bespoke forms of contract.

- Damac Properties as part of the inhouse legal team, in the negotiation of a US$ 250 million construction contract with Arabtec Holding to construct Damac’s 90 floors tower (Ocean Heights in Dubai Marina) in Dubai, UAE.

How are private mergers and acquisitions typically structured?

Most typically, private M&A transactions are affected pursuant to either an asset purchase agreement between an acquirer and the target company or a share purchase agreement between an acquirer and the shareholders of a target company.

Depending on the circumstances, the most appropriate transaction structure will depend on a variety of factors and should be discussed with your legal and financial advisers. For the success of any acquisition, choosing the right structure is critical.