Hey there, welcome to our Corporate Law Practice page! We’re a small law firm based in Toronto, and we’re passionate about helping businesses of all sizes with their legal needs.

We understand that legal stuff can be overwhelming, but don’t worry, we’re here to make it easy for you. Our experienced team of lawyers are experts in all things corporate law and are here to help you navigate any legal issues you may encounter.

Here’s what we can help you with:

- Starting your business: Investing in your startup journey begins with a solid foundation. Explore our Business Formation services to establish your company. Once you’ve laid the groundwork, navigate the exciting world of fundraising with our dedicated Raising Fund Practice to unleash your startup’s full potential.

- Contracts and agreements: We know that business is all about relationships, and that’s why we’re here to help you draft and negotiate all kinds of agreements, from sales contracts to employment agreements and everything in between.

- Buying or selling a business: Whether you’re buying or selling a business, we’re here to help you through the entire process. We’ll assist you with due diligence, drafting purchase agreements, and even employment contracts.

- Raising capital: We specialize in helping businesses navigate the complex legal landscape of raising capital, including through venture capitalists and angel investors. From Bootstrapping to Venture Capital and Government Grants: How to Fund Your Startup.

- Staying compliant:We know that staying compliant with all the rules and regulations can be a headache, but we’ve got you covered. We can help you with corporate record-keeping, compliance with regulatory requirements, and anything else you need to stay on top of.

At Fauri Law, we believe in building relationships with our clients. We want to get to know you and your business, so we can provide you with personalized legal advice and solutions that work for you.

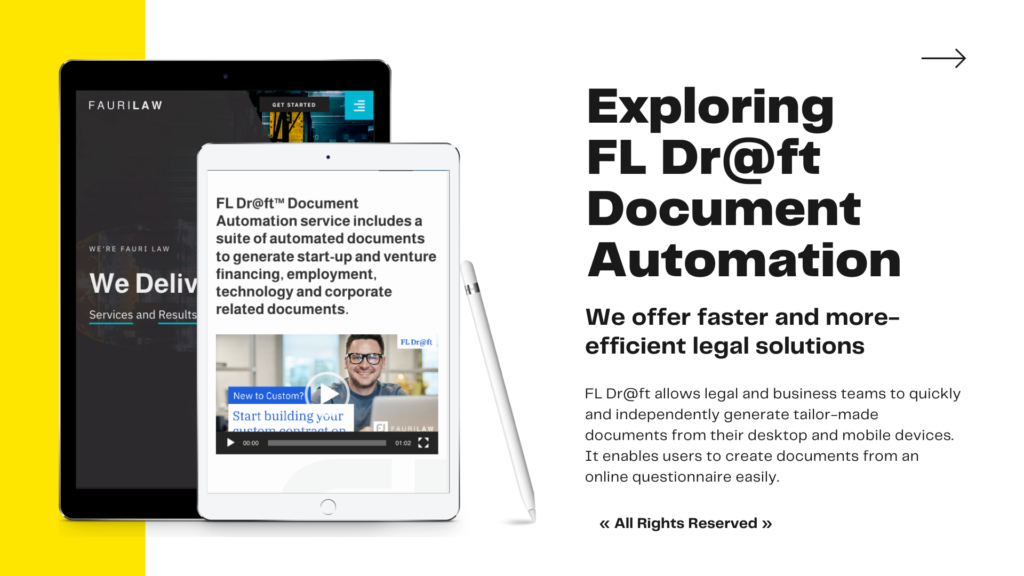

Start Building Your Documents Now

Let’s build your Letter of Intent share acquisition or commercial, promissory note, consulting, employment or stock option agreement, software license agreement, SAFE document and more so that you can get organized, raise money and gain credibility to expand your business.

Visit our FL Dr@ft™ Document Automation section of the FLConnect membership to get started today.

Get Started

Whether you are just getting your business off the ground or are looking to grow an established business, Fauri Law can help.Talk to us to discuss your needs and learn how we can put our experience to work for you and help your business thrive.

Khaled is currently working on some of Canada’s largest infrastructure projects under development by the Ontario Government in partnership with the private sector (P3). Khaled’s current and past representations include:

- Infrastructure Ontario‘s Request for Proposal Documents (RFPs) of the Go-Rail Expansion Project.

- Infrastructure Ontario‘s Go-Rail Expansion project agreement, a single fully integrated contract using the Design-Build-Finance-Operate-Maintain (DBFOM) model.

- Infrastructure Ontario’s Transit Oriented Communities (TOC) project agreements including term sheets, joint ventures, construction lease and option agreements with developers to jointly build mixed-use developments as part of Ontario Line subway project.

- Infrastructure Ontario‘s Real estate matters such as expropriations/ collect and compete, land acquisition and disposition.

- Meridian Credit Union in Toronto, in a share subscription transaction in FinTech Startup that includes legal due diligence, software licensing, drafting of transactional documents and securities law compliance on matters such as private issuer and exemptions from prospectus.

- Motusbank, a federally chartered online bank in Toronto, in standardizing the terms and conditions of the bank’s cloud-based services, including Saas agreements, software licensing agreements, click-wrap agreements, and other technology-related agreements for the use of the bank’s online users.

- Fincantieri, the largest naval shipbuilding group in the world, in naval ship IP design agreements, transfer of technology and licensing agreements negotiated and signed with several armed forces in the Middle East region to protect Fincantiari’s intellectual property rights.

- Jordan Aviation‘s major shareholder in an airline company, to conclude a US$26 million share acquisition transaction from a large international private equity firm and related escrow agreements with Citi Bank London.

- Jordan Aviation’s major shareholder in an airline company, to conclude a US$10 million share acquisition transaction.

- Jordan Aviation, in its set-up of an aviation fund of US$30 million. Established fund company, management and sponsor companies. Prepared investment management agreement and subscription agreement. Moreover, drafted dry lease contracts for aircrafts as part of the fund transaction.

- Fincantieri, in the negotiation of a joint venture transaction with Al Zamil Shipyard in KSA for the design and construction of several offshore vessels and building of facilities for military and offshore vessels in the new King Abdul Aziz Port in KSA.

- National Holding, in the acquisition by a German firm (Knauf) to 51% stake in National Holding’s subsidiary.

- National Holding, in a joint venture transaction with Vivartia, a Greek holding group based in Athens.

- National Holding, in a US$36 million acquisition by Qatari sovereign wealth fund to National Holding’s shares in a Steel Factory in Egypt.

- National Holding, in a US$40 million capitalization in a home appliances factory in Jordan, with ownership restructuring.

- Dubai Bank and Dubai Holding, a global conglomerate and sovereign wealth fund of the government of Dubai and its ruling family, in producing a due diligence report and structuring advise in respect of a US$300 million cross-border acquisition/ privatization in a state-owned Jordanian Bank.

- Dubai Holding in producing four separate legal due diligence reports with respect to acquisition transactions totaling close to US$200 million in Eastern investment group holding UK, International Energy Management Company, Jordan Airline Training and Simulation (JATS) and Jordanian Flight and Catering Services Company (Subsidiary of Alpha Co. -UK);

- Kuwait National Bank in producing a due diligence report with respect to acquisition transaction in Bank Al Etihad in Jordan.

- National Holding, in several international procurement and sale of goods contracts and trade between countries that involved contract drafting and other banking documentations such as letter of credits, bank guarantees and other documents for shipping and handling of goods based on Incoterms Rules.

- Fincantieri as part of the in-house legal team, in closing a US$5.6 billion naval shipbuilding contract signed with the Qatari Navy in 2016.

- Fincantieri as part of the in-house legal team, in the negotiation of US$ multi-billion procurement contracts, to equip and arm newly ordered warships, with suppliers such as Airbus, Raytheon, MBDA, Rolls-Royce, Thales and Leonardo.

- Eagle Hills, a leading real estate developer, in several hotels operation agreements with Marriott Inc to license the operation of several (5) stars hotels and resorts in the Middle East region including St. Regis Hotel and residences, W Hotel & Residences and Westin Hotel.

- Engie, a French multinational power company, to structure the set- up and finance of a 150 MW solar power project in Jordan.

- Fincantieri, in closing a complex “Engineering, Procurement and Construction” contract for a military shipyard in the UAE and related joint venture contract for the management and operation.

- Fincantieri in a US$250 million refitting contracts of naval units (ISS, FOS, ILS) with several naval forces in the Middle East.

- National Holding, in several international procurement and sale of goods contracts and trade between countries that involved banking arrangements such as letter of credits, bank guarantees and other documents for shipping and handling goods.

- National Holding in the setup, design and construction of Greenfield cable factory in Algeria.

- Damac Properties in providing contract drafting to construction, consultancy, plot and unit SPA related to US$ multi-billion real estate projects in Dubai, Abu Dhabi, Jordan, Egypt, Lebanon, KSA and the UK based on FIDIC, NEC and bespoke forms of contract.

- Damac Properties as part of the inhouse legal team, in the negotiation of a US$ 250 million construction contract with Arabtec Holding to construct Damac’s 90 floors tower (Ocean Heights in Dubai Marina) in Dubai, UAE.

What are the principal pros and cons of forming a federal corporation in Canada?

Pros

Incorporation under the Canada Business Corporations Act, R.S.C. 1985, c. C-44 (CBCA) provides the following advantages:

- A CBCA corporation can carry on business as of right across Canada. This includes the right to enter and carry-on business in any Canadian province or territory under its corporate name (section 15(2), CBCA).

- CBCA incorporation provides a common legal platform known throughout Canada (with the greatest recognition internationally).

- The CBCA includes a highly flexible statutory arrangement provision (section 192, CBCA).

- The CBCA no longer contains financial assistance restrictions (whether related-party or share purchase).

About 50% of the largest 200 non-financial corporations in Canada are incorporated under the CBCA.

Cons

Incorporation under the CBCA has the following disadvantages:

- At least 25% of the directors must be resident Canadians (section 105(3), CBCA). A higher proportion applies in some industries (section 105(3.1), CBCA).

- A CBCA corporation does not qualify for flow-through treatment under the US Internal Revenue Code.

- The CBCA prohibits a:

- Subsidiary from acquiring shares in its parent corporation.

- Parent corporation from allowing its subsidiary to hold shares in the parent.

- Unless it obtains an exemption from the Director under section 151(1) of the CBCA, a CBCA corporation must solicit proxies if it has more than 50 registered shareholders even if it is not a reporting issuer.

What are the principal pros and cons of forming a corporation in Ontario?

Pros

Incorporation under the Ontario Business Corporations Act, R.S.O. 1990, c. B.16 (OBCA) provides the following advantages:

- It is generally easier to clear a corporate name under the OBCA than under the Canada Business Corporations Act, R.S.C. 1985, c. C-44 (CBCA).

- OBCA incorporation avoids the additional cost of filing an annual return under the CBCA (although the annual return may be filed electronically under the CBCA for only $20 a year).

- A CBCA corporation must solicit proxies where it has more than 50 registered shareholders (while an OBCA non-offering corporation is not required to solicit proxies regardless of the number of registered shareholders).

- Professional corporations for lawyers, paralegals, public accountants, medical doctors, dentists, veterinarians and social workers practicing in Ontario are only available under the OBCA.

- The OBCA no longer contains financial assistance restrictions (whether related-party or share purchase).

Cons

Incorporation under the OBCA has the following disadvantages:

- Incorporation under the OBCA offers little name protection within, and no name protection outside, Ontario.

- The incorporation fee for articles of incorporation filed electronically under the OBCA is $300 (compared with $200 to file electronically under the CBCA).

- Like a CBCA corporation, an OBCA corporation does not qualify for flow-through treatment under the US Internal Revenue Code. Only Alberta, British Columbia and Nova Scotia have types of unlimited liability corporations that qualify.

- At least 25% of the members of the board of directors must be resident Canadian as defined in the OBCA (section 118(3), OBCA), which is also the minimum requirement under the CBCA but not under the laws of the territories and several sister provinces including British Columbia, New Brunswick, Nova Scotia and Québec).

- Except in rare circumstances, the OBCA prohibits:

- a subsidiary from acquiring shares in its parent corporation; or

- a parent corporation from allowing a subsidiary to hold its shares.

Are there any limits on the classes or series of shares that can be issued?

Corporations cannot generally impose restrictions on the issue of shares of any class or series, unless the restrictions are authorized by its articles. However, a unanimous shareholder agreement may impose controls on the issue of shares

Shares of series of the same class must participate ratably in respect of the payment of arrears of cumulative dividends, declared non-cumulative dividends and return of capital on dissolution or liquidation, if these claims are not paid in full (section 25(2) and (3), Business Corporations Act, R.S.O. 1990, c. B.16). Any other restrictions on a class or series of shares must be set out in the articles or a unanimous shareholder agreement.

What are the limitations on the ability of a corporation to pay dividends on shares?

Subject to any restrictions in the articles of a corporation incorporated under the Ontario Business Corporations Act, R.S.O. 1990, c. B.16 (OBCA) or a unanimous shareholder agreement (USA), directors have the discretion to declare and pay dividends on shares (section 38(1), OBCA).

However, except for stock dividends, directors may not declare or pay dividends where at the time or as a result the:

- Corporation is (or would as a result of the dividend) be unable to meet its liabilities as they become due.

- Realizable value of the corporation’s assets is (would be as a result of the dividend) less than the sum of the corporation’s liabilities and the stated capital of all classes.(Section 38(3), OBCA.)

If dividends are paid in breach of these solvency tests, directors are jointly and severally liable for the unlawful dividend payment to the extent not disgorged by the recipient shareholders (section 130(2)(c), OBCA). However, directors are protected if they rely in good faith on the corporation’s financial statements or the report of a lawyer, accountant or other person whose profession lends credibility to any statement made by that professional (section 135(4), OBCA).

Typically, shareholder approval is not required for a corporation to declare and pay dividends unless so specified in a USA.

What are the requirements for Canadian representation on the board?

Under the Ontario Business Corporations Act, R.S.O. 1990, c. B.16 (OBCA), at least 25% of the directors of a corporation must be resident Canadian as defined in the OBCA (section 118(3), OBCA).

Under the Canada Business Corporations Act, R.S.C. 1985, c. C-44 (CBCA), at least 25% of the directors of a CBCA corporation must be resident Canadian as defined in the CBCA (section 105(3), CBCA). Generally, a majority of the members of the board must be resident Canadians if the corporation is engaged in the following business sectors:

- Uranium mining.

- Book publishing, sales or distribution.

- Film and video distribution.(Section 105(3.1), CBCA and section 16, Canada Business Corporations Regulations, 2001, SOR/2001-512.)

What activities require shareholder consent?

Generally, a corporation can require shareholder approval for any specific corporate authorization by stating so in a unanimous shareholder agreement (USA). However, for certain fundamental corporate changes, the Ontario Business Corporations Act, R.S.O. 1990, c. B.16 (OBCA) requires a corporation to obtain shareholder approval. Fundamental corporate changes include:

- Amendments to articles (section 168(1), OBCA).

- An amalgamation

- The extraordinary sale of all or substantially all of a corporation’s property

- A continuance of the corporation under the laws of another jurisdiction (section 180, OBCA).

- Dissolution or liquidation

For these fundamental corporate changes, the OBCA requires approval by special resolution. In some cases, the fundamental change requires a special resolution of a class or series of shares, voting separately.

Is there a statutory provision for pre-emptive rights?

Under the Ontario Business Corporations Act, R.S.O. 1990, c. B.16 (OBCA), a shareholder does not have the pre-emptive right to subscribe to an additional issue of shares or to any security convertible into shares unless this right is expressly granted to the shareholders in the articles (section 26, OBCA) or a unanimous shareholder agreement.